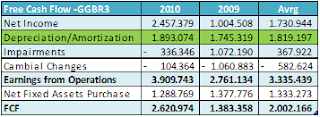

A simple look to GGBR cash flow shows that FCF is about 8% of current market value:

What draws my attention is the huge value of depreciation/amortization that is enough to cover investments in fixed assets. The damn is the immense net debt nearly BRL 12 billions, six time FCF.

What about?

Monday, July 11, 2011

GGBR3 - Gerdau

Under no circumstances does any article or opinion posted on this blog represents any kind of advice, suggestion or recommendation to buy or sell any security. We also do not guarantee the accuracy of any information contained in any posting on this blog.

Tags:

Commodities

Related Posts

Subscribe to:

Post Comments (Atom)

3 comments:

shit

hello i am an old ggb investor. They have a lot of money from BNDES Brazilian government bank that GGB used to built hydro electrical plants and acquire companies. I know 2 that are finished and give them power autonomy in Brazil.

They just capture 5 bi reais increasing capital this will be represented in 2Q11 report.

The iron ore mining reserve and the coal mining in Colombia give them a lot of medium and long term competitive advantage.

They are a recycle business much more different from other steel companies.

compare in google finance apple and ggb 10 years projection and you are going to see that ggb is a good pick.

Hello moki, we appreciate your comments. Welcome to the blog.

Good memories: I forgot about GGBR public offering. New shares are already counting to its market value, but BRL 5 billion still don´t.

So probably net debt is now about BRL 7 billion, quite acceptable.

About the projections you mentioned, sorry, but I don't give a shit for them.

Post a Comment

We encourage your feedback and we will take your comments into serious consideration. However, you must be warned that any comment that does not follow the blog philosophy (Value Investing and Behavioural Finance) will be promptly removed.