I'll try to evaluate Vale cash flow. I'll not consider 2010 results, because they are clearly over the average. Also, I'll not consider previous results for 2007, because Vale bought Inco and that had a huge impact on financial statements since then.

Showing posts with label Commodities. Show all posts

Showing posts with label Commodities. Show all posts

Friday, January 6, 2012

Thursday, January 5, 2012

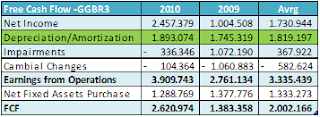

Gerdau Free Cash Flow

On this post I had estimated Gerdau free cash flow. But I hadn't deducted investments in work capital. I'll try to do that now.

Since 2005, Gerdau work capital has been around 20% of net revenue for the period of 2005-2007 and 25% for 2008-2010. So I'll take 25% of net revenue as a measure of Gerdau needs for work capital.

Tags:

Commodities

Wednesday, December 28, 2011

Margin of Safety on Suzano Business

So I took all assets and properly discounted by a rate that I think is proportional to the risk of conversion of that assets in money. I also considered all liabilities recorded plus 50% of possible demands that wasn't provisioned (they only record provisions whose chances of loss are probable).

Tags:

Commodities

Monday, December 19, 2011

SUZB5 - Market Value x Enterprise Value

Regarding the previous post (Market Value x Enterprise Value), I did some calculations on Suzano numbers (average last 3 years).

- I first calculated cash from operations and then divided by its market value, which gives a nice yield above 20%.

- Then I added to the previous calculated CFO interests expenses and then divided by enterprise value, yielding 12.5%.

Tags:

Commodities,

Thought

Sunday, December 18, 2011

Magnesita's 3Q11 Cash from Operations = deception

Take a look at this shit: Release 3Q11

They start the release with this big achievement:

MAGNESITA REGISTRA FLUXO DE CAIXA OPERACIONAL DE

R$ 461 MILHÕES, RECORDE NO ACUMULADO DO ANO, E LUCRO

LÍQUIDO 12% SUPERIOR AO DO 2T11

Let's see the 2011 acumulated Cash Flow Statement at page 21.

It starts with net earnings and add some adjustments, as usual.

Then things start to get interesting:

1) They added 63.116 of judicial litigation received - that's ok for a cash flow statement, but doesn't justify all the cheers about the CFO, because it's NONRECURRENT.

2) They added more 48.883 of asset sales - shouldn't this be cash from investiments? This is obviously NONRECURRENT and probably NONOPERATIONAL

3) They added 119.321 of the increase in accounts payable (Fornecedores e empreiteiros). This is also NONRECURRENT.

Subtracting all those NONRECURRENTS the CFO would be only 229,68 millions. It's just a 50% difference from the headline!

I looked for any comments about the CFO but they just cheered about their great accomplishment.

They start the release with this big achievement:

MAGNESITA REGISTRA FLUXO DE CAIXA OPERACIONAL DE

R$ 461 MILHÕES, RECORDE NO ACUMULADO DO ANO, E LUCRO

LÍQUIDO 12% SUPERIOR AO DO 2T11

Let's see the 2011 acumulated Cash Flow Statement at page 21.

It starts with net earnings and add some adjustments, as usual.

Then things start to get interesting:

1) They added 63.116 of judicial litigation received - that's ok for a cash flow statement, but doesn't justify all the cheers about the CFO, because it's NONRECURRENT.

2) They added more 48.883 of asset sales - shouldn't this be cash from investiments? This is obviously NONRECURRENT and probably NONOPERATIONAL

3) They added 119.321 of the increase in accounts payable (Fornecedores e empreiteiros). This is also NONRECURRENT.

Subtracting all those NONRECURRENTS the CFO would be only 229,68 millions. It's just a 50% difference from the headline!

I looked for any comments about the CFO but they just cheered about their great accomplishment.

Tags:

Commodities,

Shenanigans

Friday, December 2, 2011

Vale 25 billions lawsuit

Vale is being sued to pay BRL 25 billions due to tax contigencies (4.66 per share) that hasn't been provisioned. Since it's being paying since 2008 an average of 1.66 per share in dividends, that amount to be paid is 2.8 times average dividends distributed.

Also, Vale has provisioned just 1.44 billion for tax contingencies and the total possible tax demands hits BRL 40 billions!

In addition to contingencies for which we made provisions, the company is part in claim where the loss expectation is considered possible for Vale and for its attorneys and that represent on September 30, 2011 and December 31, 2010, the total amount of R$ 40,769,086 and R$ 9,605,546 in the consolidated company and R$ 34,262,857 and R$ 4,484,876 on the parent company, respectively. For these cases it was not recorded provision. The variation in the claims values regarding reasonably possible contingencies is related with cases in which is discussed the payment in Brazil, of income tax and social contribution on net income on the profits of foreign subsidiaries.

Tags:

Commodities

Sunday, November 27, 2011

VALE5 - Vale

As I saw that a great deal of funds are buying VALE5, I compared its main numbers with competition ones.

Vale is indeed the most profitable and is cheaper than the others two (considering its higher EBITDA Margin).

Vale is indeed the most profitable and is cheaper than the others two (considering its higher EBITDA Margin).

Tags:

Commodities

Monday, September 12, 2011

Suzano's business plan for 2024

Extrated from the 2011 Reference Form:

10.10 - Plano de negócios

10.10 - Plano de negócios

Tags:

Commodities

Thursday, September 1, 2011

MAGG3 - Magnesita

I'll just post some notes about Magnesita I found searching on the net so far:

- I compared RHI numbers, the world market leader in the development, production and service of refractory materials, to Magnesita ones (RHI numbers were converted to BRL):

- The company announced investments of R$ 300 million in two projects for vertical integration into raw materials, aiming to reach 90% of vertically.

- It's trying to implement CCP model to price it's products. I didn't get that right.

- MAGG is charging about 100 millions in depreciation per year, so CFO is much higher than published earnings.

- FAMA has a nice share of the company.

Tags:

Commodities

Monday, August 15, 2011

KLBN4 - Klabin

I tried to estimate normal cash flow for Klabin:

But I'm not sure about 3 points. Let me know what is your opinion.

Tags:

Commodities

Monday, July 25, 2011

PETR4 - Petrobras

Some thoughts about Petrobras investment plan for 2011-2015 (all numbers are in BRL billions):

- PETR plans to invest in the next 5 years 389,00;

- It will have to pay more 37,50 in dividends (considering 25% of earnings of 30,00);

- Cash flow stood for about 50,00 in the last 3 years. So it will generate 250,00 in the next 5 years;

- So cash consumption till 2015 will be 176,50;

- Since current debt amount 65,00, net debt will be 241,50 in 2015;

- Increase in production will be 44%. If cash flows follows the same percentage, CF in 2015 will be 72,00;

- Earnings will grow to 43,20, so dividends will be 10,80;

- In 2015 FCF will be 61,20, less investments in maintenance, that is not negligible, but I don't know how much is;

Tags:

Commodities

Tuesday, July 19, 2011

CSNA3 - CSN

CSN is down 30% this year, so I decided to take a look. From the company web site I got historical dividends since 2005:

When CSN distributed JCP I provided to discount 15% IRRF. Disregarding 2005 year that is outside mean, we have an average dividend in the last 5 years of BRL 1.86 billion. This is currently yielding 7.4%, which is very attractive. So I'll take a closer look at CSN.

When CSN distributed JCP I provided to discount 15% IRRF. Disregarding 2005 year that is outside mean, we have an average dividend in the last 5 years of BRL 1.86 billion. This is currently yielding 7.4%, which is very attractive. So I'll take a closer look at CSN.

Tags:

Commodities

Monday, July 11, 2011

GGBR3 - Gerdau

A simple look to GGBR cash flow shows that FCF is about 8% of current market value:

What draws my attention is the huge value of depreciation/amortization that is enough to cover investments in fixed assets. The damn is the immense net debt nearly BRL 12 billions, six time FCF.

What about?

What draws my attention is the huge value of depreciation/amortization that is enough to cover investments in fixed assets. The damn is the immense net debt nearly BRL 12 billions, six time FCF.

What about?

Tags:

Commodities

Friday, July 8, 2011

SUZB5 - Suzano - Return on Investments

I know it's almost a futurology issue, but I'll try to shed some light about what would be the return on planned investments until 2015.

- I went to the company site and from there I got that quarterly median net margin (earnings/revenue) for the last 20 quarters is 13.3%.

- The 2 projects (Maranhão and Piauí) will add 3 million tons of hardwood pulp. As international price is now at US$ 870.00, the investments will earn US$ 2,6 billion revenue.

- That revenue, at historically net margin will yield earnings of about US$ 350 millions.

- Orbe said (I failed to confirm this number in the company site) that this investments will consume about US$ 7 billions. (I saw now in company site that the estimated total value of investments for the 2 projects is US$ 5.3 billions)

- So the expected return on new investments would be miserable 5% (with new company data it jumps to 6.6%).

Probably I misunderstood or forget something. However, if my figures are closer to what would be the expected returns, I'm certainly out of this shit.

Tags:

Commodities

Thursday, July 7, 2011

SUZB5 - Suzano Pulp and Paper

I will be editing this post while gathering more information. For now, look at this:

- This graph shows production growth:

- This one shows EBIT:

That is: company has been investing a lot, but EBIT has not gone up. So, what will be the return of heavy investments that SUZB plan to do in the next 4 years?

Now I try to estimate FCF:

Tags:

Commodities

Monday, June 20, 2011

USIM5 - Usiminas

What about Usiminas? It has dropped 42% in the last 12 months and is now close to the minimum reached in 2008 crisis. Even through a bad moment, yield is 4.4% and P/E 11. If we consider historical numbers for earnings of 2.5 billions and dividends of 1 billion, P/E would go to 5.5 and yield to 7.5%.

I prefer USIM to GGBR because its debt is lower and USIM plan to invest in ore mining, so its business could become full integrated, as CSNA is.

What do you think about?

I prefer USIM to GGBR because its debt is lower and USIM plan to invest in ore mining, so its business could become full integrated, as CSNA is.

What do you think about?

Tags:

Commodities

Sunday, May 15, 2011

Steel

Is there an oportunity in Steel?

Those companies (CSN, GOAU and USIM) are among the worst performing blue chips in the last 12 months. The sector is out of favor because of bad results.

But, even delivering about half the earnings show in past years, USIM5 is trading for a P/E ratio of 12,45. It's debt to equity ratio is of only 0,45. USIM also has a significant business in iron ore mining.

Those companies (CSN, GOAU and USIM) are among the worst performing blue chips in the last 12 months. The sector is out of favor because of bad results.

But, even delivering about half the earnings show in past years, USIM5 is trading for a P/E ratio of 12,45. It's debt to equity ratio is of only 0,45. USIM also has a significant business in iron ore mining.

Tags:

Commodities

Monday, April 18, 2011

USIM5 - Usiminas

I don't know why this share has plunged so much!

It's now at 17, while USIM3 is at 27.

At this price, USIM5 is trading at a median P/E of 5 years of just about 7,0.

Do you know something?

I've read something about CSN and Gerdau taking control, but why is it dropping?

It's now at 17, while USIM3 is at 27.

At this price, USIM5 is trading at a median P/E of 5 years of just about 7,0.

Do you know something?

I've read something about CSN and Gerdau taking control, but why is it dropping?

Tags:

Commodities

Subscribe to:

Posts (Atom)