Let's see what that billionaire is investing on:

From www.cvm.gov.br, the portfolio owned by L. Par Fundo de Investimento em ações in jun / 2011 (the fund, owned by Lirio Parissoto, is worth more than 2.5 billion BRL):

Sunday, July 31, 2011

Friday, July 29, 2011

Portfolio Reallocation

I'm doing some reallocations on my portfolio before pouring more money in.

Today, for example, I sold PTPA and TKNO, both with slight profits, to buy CSNA and BBDC.

I think it makes no sense now hold those positions when you can buy CSNA yielding 8% and BBDC with a P/E nearly 8.0.

Tags:

Portfolio

Thursday, July 28, 2011

Just for Fun

Take a look when you have nothing to do, just for fun, and to see who your competitors are:

http://www.guiainvest.com.br/mural/mndl4.aspx

http://www.guiainvest.com.br/mural/mndl4.aspx

Tags:

Nonsense

BBAS3 - Banco do Brasil

I took all results available in Fundamentus for BBAS3. It's exactly 8 years of data.

Then I calculated quarterly return (ROE) and after that I excluded the best 8 quarters.

For the remaining 6 years of worst returns I get an average ROE of 23%.

That applied to the current net equity would generate BRL 12 billions.

So BBAS3 can be bought for just 6 times its average earnings.

Also, Banco do Brasil has been distributing average dividends since 2008 of BRL 3.5 billions per year, wich gives a yield of 6.7% (I discounted 15% of all values, because de series doesn't shows what is dividend and what is JCP).

In short: Fundamentus data for BBAS3 are not distorted in relation to historical mean.

Then I calculated quarterly return (ROE) and after that I excluded the best 8 quarters.

For the remaining 6 years of worst returns I get an average ROE of 23%.

That applied to the current net equity would generate BRL 12 billions.

So BBAS3 can be bought for just 6 times its average earnings.

Also, Banco do Brasil has been distributing average dividends since 2008 of BRL 3.5 billions per year, wich gives a yield of 6.7% (I discounted 15% of all values, because de series doesn't shows what is dividend and what is JCP).

In short: Fundamentus data for BBAS3 are not distorted in relation to historical mean.

Tags:

Banks

RDCD x CIEL

I think the worst fase of the new scenario of the acquirance business is over.

Indicador CIELO RDCD

margem líquida 37,80% 36,30%

ROL (2Q11/1Q11) 3,40% 9,50%

Costs (2Q11/1Q11) 9,90% 4,80%

Expenses (2Q11/1Q11) -14,80% 10,70%

MDR credit 1,17% 1,15%

MDR debit 0,74% 0,74%

MDR credit (2Q11/1Q11) -0,05pp +0,02pp

MDR debit (2Q11/1Q11) -0,02pp +0,03pp

POS rent revenue (2Q11/1Q11) -1,20% 4,60%

Prepaiment result (2Q11/1Q11) 16,20% 11,90%

Credit volume of transacions (2Q11/1Q11)5,60% 9,80%

Debit volume of transacions (2Q11/1Q11) 7,40% 4%

Cost/transaction (BRL) 0,313 0,374

Indicador CIELO RDCD

margem líquida 37,80% 36,30%

ROL (2Q11/1Q11) 3,40% 9,50%

Costs (2Q11/1Q11) 9,90% 4,80%

Expenses (2Q11/1Q11) -14,80% 10,70%

MDR credit 1,17% 1,15%

MDR debit 0,74% 0,74%

MDR credit (2Q11/1Q11) -0,05pp +0,02pp

MDR debit (2Q11/1Q11) -0,02pp +0,03pp

POS rent revenue (2Q11/1Q11) -1,20% 4,60%

Prepaiment result (2Q11/1Q11) 16,20% 11,90%

Credit volume of transacions (2Q11/1Q11)5,60% 9,80%

Debit volume of transacions (2Q11/1Q11) 7,40% 4%

Cost/transaction (BRL) 0,313 0,374

Tags:

Credit Card

Wednesday, July 27, 2011

ITUB3 - Itau

From Itau site I got the following numbers:

Avrg ROE last 10 Years: 28.5%

Avrg ROE last 3 Years: 23.0%

Let's be conservative and consider that Itau can maintain 20% profitability from here now on. As net equity amounts now for BRL 63.7 billions, earnings can be expected to be around 12.7 (last year was 13.3).

So, at current market value P/E is less than 10!

Would you bother to take a share in this excelent asset?

Using the same reasoning, BBDC3 would be trading now for 8.8 its earnings.

It's a matter of taste!

And BBAS3 for less than 7.0 (and I'm using ROE of 20%, although avrg ROE is over 25% since 2005).

Tags:

Banks

Monday, July 25, 2011

CGRA4 - Grazziotin

CGRA reached a nice valuation. It generated an average of 36 million in cash per year in 2009/2010 and invested just 15 millions (investment for expansion included). So FCF is about 20 millions, a yield of 7%.

Grazziotin also have nearly 100 millions in reforestation, lands, buildings and benefactories, more 70 millions in cash. And receivables.

P/E: 8.40

P/BV: 1.0

Yield: 7.0%

Grazziotin also have nearly 100 millions in reforestation, lands, buildings and benefactories, more 70 millions in cash. And receivables.

P/E: 8.40

P/BV: 1.0

Yield: 7.0%

Tags:

Commerce

PETR4 - Petrobras

Some thoughts about Petrobras investment plan for 2011-2015 (all numbers are in BRL billions):

- PETR plans to invest in the next 5 years 389,00;

- It will have to pay more 37,50 in dividends (considering 25% of earnings of 30,00);

- Cash flow stood for about 50,00 in the last 3 years. So it will generate 250,00 in the next 5 years;

- So cash consumption till 2015 will be 176,50;

- Since current debt amount 65,00, net debt will be 241,50 in 2015;

- Increase in production will be 44%. If cash flows follows the same percentage, CF in 2015 will be 72,00;

- Earnings will grow to 43,20, so dividends will be 10,80;

- In 2015 FCF will be 61,20, less investments in maintenance, that is not negligible, but I don't know how much is;

Tags:

Commodities

Friday, July 22, 2011

Why I can make money

I'm not a smart guy but I'm greatly happy to be surrounded by dumb people.

Look what happened with Mundial, a piece of shit that worth nothing.

- It has been trading for 30 cents since begining this year;

- Then, some crazy optimism soared company share price to above 5, an increase of greater than 1.500% in less than 3 months;

- With that valuation, company multiples were: P/E of 130, P/BV of 15 and EV/EBIT greater than 60 (high indebted company);

- During the gold time, average volume was nearly 200 million, one of the greatest of Ibovespa;

- So unexpected pessimism dropped prices over than 85% in just 3 days!

Also worth reading this article. Following are some highliths:

Tags:

Behavioural,

Nonsense

Tuesday, July 19, 2011

CSNA3 - CSN

CSN is down 30% this year, so I decided to take a look. From the company web site I got historical dividends since 2005:

When CSN distributed JCP I provided to discount 15% IRRF. Disregarding 2005 year that is outside mean, we have an average dividend in the last 5 years of BRL 1.86 billion. This is currently yielding 7.4%, which is very attractive. So I'll take a closer look at CSN.

When CSN distributed JCP I provided to discount 15% IRRF. Disregarding 2005 year that is outside mean, we have an average dividend in the last 5 years of BRL 1.86 billion. This is currently yielding 7.4%, which is very attractive. So I'll take a closer look at CSN.

Tags:

Commodities

Thursday, July 14, 2011

Cielo versus Redecard

The article confirms my thought about Cielo and Redecard: the Cielo's stakeholders, Banco do Brasil and Bradesco, are among it's biggest strenghts. The larger size also is important, because the card acquirance is a business where size matters.

Valor Econômico: Redecard quer brigar pela ponta

Valor Econômico 14/07: "Falta, porém, combinar com o concorrente. Yamaguti sabe que, para a Redecard ser líder de mercado, o setor precisa estar totalmente aberto - e isso hoje significa vencer a resistência de Bradesco e Banco do Brasil (BB), acionistas controladores da Cielo, para que Redecard também passe a aceitar em sua rede os cartões Visa Vale e Elo. "Estamos abertos, não temos ciúmes de nada", avisa Yamaguti. Com a American Express, hoje nas mãos do Bradesco, também não houve negociação até aqui."

Valor Econômico: Redecard quer brigar pela ponta

Valor Econômico 14/07: "Falta, porém, combinar com o concorrente. Yamaguti sabe que, para a Redecard ser líder de mercado, o setor precisa estar totalmente aberto - e isso hoje significa vencer a resistência de Bradesco e Banco do Brasil (BB), acionistas controladores da Cielo, para que Redecard também passe a aceitar em sua rede os cartões Visa Vale e Elo. "Estamos abertos, não temos ciúmes de nada", avisa Yamaguti. Com a American Express, hoje nas mãos do Bradesco, também não houve negociação até aqui."

Tags:

Credit Card

Tuesday, July 12, 2011

EURO11 - Europar

I sold my EURO11 today because:

- Since 2008 it has been distributing the same amount (that is, there is no correction due to inflation, so the yield you got is not a real one);

- If you look to the 2010 financial statements, you will see strange stuffs there: other expenses of BRL 700 thousands and there was cash consumption just to pay the same 1.36 they are paying (since 2008);

- I mailed them about these issues a moth ago and no answer was offered.

Tags:

Real Estate

Monday, July 11, 2011

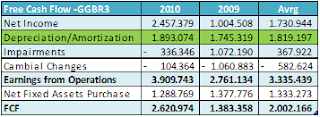

GGBR3 - Gerdau

A simple look to GGBR cash flow shows that FCF is about 8% of current market value:

What draws my attention is the huge value of depreciation/amortization that is enough to cover investments in fixed assets. The damn is the immense net debt nearly BRL 12 billions, six time FCF.

What about?

What draws my attention is the huge value of depreciation/amortization that is enough to cover investments in fixed assets. The damn is the immense net debt nearly BRL 12 billions, six time FCF.

What about?

Tags:

Commodities

People Never Learn

Most people never learn.

See the bullshits this moron says about Buffett here, if you have time and stomach for it.

See the bullshits this moron says about Buffett here, if you have time and stomach for it.

Buffett said in its annual meeting in April that gold is useless and that people act like fools when the price is near the highs. "There is no doubt about the effect of price increases in behavior," said Buffett.

Tags:

Nonsense

Friday, July 8, 2011

SUZB5 - Suzano - Return on Investments

I know it's almost a futurology issue, but I'll try to shed some light about what would be the return on planned investments until 2015.

- I went to the company site and from there I got that quarterly median net margin (earnings/revenue) for the last 20 quarters is 13.3%.

- The 2 projects (Maranhão and Piauí) will add 3 million tons of hardwood pulp. As international price is now at US$ 870.00, the investments will earn US$ 2,6 billion revenue.

- That revenue, at historically net margin will yield earnings of about US$ 350 millions.

- Orbe said (I failed to confirm this number in the company site) that this investments will consume about US$ 7 billions. (I saw now in company site that the estimated total value of investments for the 2 projects is US$ 5.3 billions)

- So the expected return on new investments would be miserable 5% (with new company data it jumps to 6.6%).

Probably I misunderstood or forget something. However, if my figures are closer to what would be the expected returns, I'm certainly out of this shit.

Tags:

Commodities

Thursday, July 7, 2011

SUZB5 - Suzano Pulp and Paper

I will be editing this post while gathering more information. For now, look at this:

- This graph shows production growth:

- This one shows EBIT:

That is: company has been investing a lot, but EBIT has not gone up. So, what will be the return of heavy investments that SUZB plan to do in the next 4 years?

Now I try to estimate FCF:

Tags:

Commodities

Consumer credit in Brazil

Financiamento de veículos: inadimplência aumenta

O atraso nas prestações vencidas há mais de 90 dias é de 3,6% de todos contratos, numa trajetória crescente. Era de 2,6% em janeiro, foi a 2,8% em fevereiro, a 3% em março e a 3,2% em abril.

O atraso nas prestações vencidas há mais de 90 dias é de 3,6% de todos contratos, numa trajetória crescente. Era de 2,6% em janeiro, foi a 2,8% em fevereiro, a 3% em março e a 3,2% em abril.

Tags:

Economy

Wednesday, July 6, 2011

Several blue chips selling for less than its equity

From FUNDAMENTUS

Papel P/L P/VP

PETR4 7,99 0,98

USIM5 11,55 0,81

FIBR3 9,78 0,61

CPLE6 10,7 0,99

CESP6 79,68 0,95

SUZB5 5,9 0,53

MRFG3 25,08 0,85

Papel P/L P/VP

PETR4 7,99 0,98

USIM5 11,55 0,81

FIBR3 9,78 0,61

CPLE6 10,7 0,99

CESP6 79,68 0,95

SUZB5 5,9 0,53

MRFG3 25,08 0,85

Tuesday, July 5, 2011

China's Hidden Debt

A recent article from The Economist shows that debit in China could be substantially high than published, due to the hidden debts of its local governments.

The official public debt of the central government was only 19% of GDP at the end of 2010. Adding the debts of local governments, the non-performing loans of the banks and other liabilities, such as central-bank bills, the public debt amounts to about 80% of GDP according to Andrew Batson and Janet Zhang of GaveKalDragonomics, a consultancy in Beijing. That sounds high for a developing country.

The government has never revealed how much debt the local-government vehicles took on. Despite this opacity, or perhaps because of it, these hidden liabilities have become one of the four big worries haunting China-watchers, along with the property bubble, inflation and lightly regulated trust companies. Victor Shih of Northwestern University has described the debts as a “big rock-candy mountain”. In June 2010, he projected it might reach as high as 24 trillion yuan ($3.7 trillion) by the end of 2012, or over half of China’s GDP.

Tags:

Economy

Aviation is bad for your financial health

I always told you: aviation is a bad business.

Aéreas acumulam perda de R$ 5,7 bi em cinco anos.

"Esse tipo de resultado não é exclusivo do Brasil. Esse é um setor que destrói valor, com excesso de capacidade, margens de lucro pequenas e forte influência de qualquer fator externo", afirma o especialista em aviação da consultoria Bain & Company, André Castellini.

Aéreas acumulam perda de R$ 5,7 bi em cinco anos.

"Esse tipo de resultado não é exclusivo do Brasil. Esse é um setor que destrói valor, com excesso de capacidade, margens de lucro pequenas e forte influência de qualquer fator externo", afirma o especialista em aviação da consultoria Bain & Company, André Castellini.

Monday, July 4, 2011

Brazil Credit Bubble

Again Financial Times argues that Brazil is exposed to a credit bubble, transitioning from a boom to bust. Main points are:

- The consumer debt service burden, which stood at 24 per cent of disposable income in 2010, is now slated to rise to 28 per cent in 2011. This compares with 16 per cent for an “overburdened” US consumer and a mid-single digit reading for other emerging markets such as China and India.

- But they calculate that the debt service burden for the so-called “middle class” in Brazil has now breached 50 per cent of disposable income, as high income earners have little need to borrow at rates which are punitive and most of the consumer credit is therefore being directed to the “middle class” for consumption.

- Meanwhile, delinquencies in Brazil (defaults in excess of 15 days) have begun to move up rapidly, from 7.8 per cent to 9.1 per cent of total loans between December 2010 and May 2011.

Important to highlight that this is very troubling as credit indicators have deteriorated even as the economy has stayed strong and the unemployment rates are at a record low. When they begin to deteriorate before any economic weakness it usually represents a structural problem relating to underlying cash flow or underwriting weakness in the quality of credit – Brazil has both problems.

Tags:

Economy

What Blue Chip is?

According to Wikipedia, blue chips comes from casino, which originates in poker , where the blue chips are the most valuable. It is used in stock markets by analogy, to describe actions of well-established companies, large national and international, with proven profitability, especially in the long term, and with few obligations, resulting in positive economic and financial situation.

But this news promoted Mundial and Ecodiesel, two pieces of shits highly traded on Bovespa, to blue chips, just because a crazy bunch of speculators are now very optimistic.

Unbelievable!

But this news promoted Mundial and Ecodiesel, two pieces of shits highly traded on Bovespa, to blue chips, just because a crazy bunch of speculators are now very optimistic.

Unbelievable!

Tags:

Nonsense

China's Hard Landing

In this 5 series on Bloomberg, A. Gary Shilling, author of The Age of Deleveraging: Investment Strategies for a Decade of Slow Growth and Deflation, states that China is headed for a hard landing.

Part1 - Part2 - Part3 - Part4 - Part5

Part1 - Part2 - Part3 - Part4 - Part5

Tags:

Economy

Subscribe to:

Comments (Atom)